March 2014 U.S. Poverty Action

Fostering Economic Mobility through Asset Building

Take Action! Write Letters Urging Congress to Support the Financial Security Credit

- Introduce yourself to your representative or senator as a constituent and as a RESULTS volunteer. Tell them you want Congress to support policies that foster economic mobility.

- Share that you are concerned that many Americans are just one crisis away from falling into poverty. The Corporation for Enterprise Development (CFED)’s Assets and Opportunities Scorecard shows that 44 percent of Americans are “liquid asset poor” meaning that, if they lost their income, they don’t have enough savings/assets to make it three months above the poverty line.

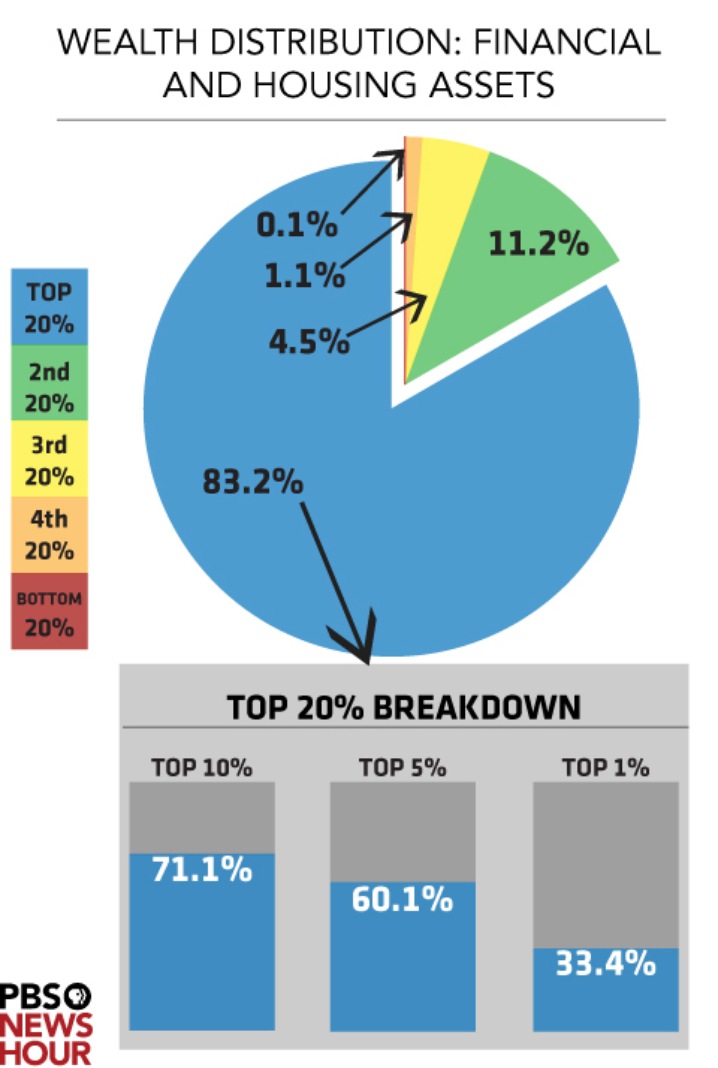

- Tell them that the wealth gap has grown worse, especially for people of color. Over the past 25 years, the wealth gap between white and black households has nearly tripled to $236,500.

- Voice support for policies that help low-income families build for the future through savings.

- Inform them that the Financial Security Credit (FSC) can help families build for the future by using the convenience of tax time to encourage low-income taxpayers to save. The FSC is a matched deposit for low-income tax filers who agree to direct deposit part of their tax refund into an eligible savings product.

- Share that a recent pilot program (SaveUSA) has shown that when low-income families are given the opportunity and incentive to save, they will.

- Ask your members of Congress to do the following:

- Senators: Please speak with Senate Finance Committee Chairman Ron Wyden and Ranking Member Orrin Hatch and urge them help families save for the future by including the Financial Security Credit (FSC) in any tax reform legislation.

- Representatives: Please co-sponsor the Financial Security Credit Act of 2013 (H.R. 2917). In addition, please speak with House Ways and Means Committee Chairman Dave Camp and Ranking Member Sander Levin and urge them help families save for the future by including the Financial Security Credit (FSC) in any tax reform legislation.

- Thank them for their time and ask for a prompt response to your letter.

Note: To find contact information for congressional offices and the name of the early childhood aide, visit our Elected Officials page (http://capwiz.com/results/dbq/officials/). For directory assistance, you can also contact the U.S. Capitol Switchboard at (202) 224-3121.

To truly help low-income, hard-working Americans prepare for their future, we need to facilitate saving and asset building. Savings and assets are a critical part of any family’s personal “safety net.” Savings help improve household stability, reduce government dependency, and move families and children out of poverty. Pew’s Economic Mobility Project shows that 7 out of 10 children who are born into low-income families who save are able to move up from the bottom 20 percent income category over a generation.

Fortunately, there is an innovative idea already available to help low-income households get on the path to saving quickly and easily. The Financial Security Credit (FSC) uses the convenience and timing of tax time to promote savings. Because low-income taxpayers typically receive their largest check of the year at tax time (from the Earned Income Tax Credit and Child Tax Credit), this is an ideal time to encourage saving. Here is how it works:

- At tax time, the taxpayer checks a box on the tax return agreeing to deposit all or part of his/her tax refund into an eligible savings product (e.g. IRAs, 401(k)s, 529 College Savings Plans, Coverdell Education Accounts, U.S. Savings Bonds, and certificates of deposit). If the taxpayer does not have an account, he/she could sign up for one on their tax return. The IRS would then directly deposit that amount into the account.

- If participants maintain the balance for at least eight months, they would receive a fifty percent match for their deposits, up to $500 per year. This would provide hard-working taxpayers the incentive to still save while on a limited budget. The FSC would only be available to low-income households.

Learn more about RESULTS at www.results.org. For more information about RESULTS’ Economic Mobility campaign, go to https://results.org/issues/us_poverty_campaigns/us_current_campaigns/.

We know it works. In 2008, New York City started the SaveNYC program, which is similar to the FSC. Participants in SaveNYC who deposited part of their refund into a savings account, received a match if they maintained that savings amount for a year. The program was very successful; 70 percent of participants maintained their savings for a year and received the match. As a result of its success, SaveNYC became SaveUSA and has been expanded into other cities.