February 2014 U.S. Poverty Action

Media Action: Building Ladders Out of Poverty

January 2014 marked the 50th anniversary of President Lyndon Johnson’s War on Poverty. While the War on Poverty was a great success, the work is far from finished. Unfortunately, some leaders in Washington are trying to dismantle rather than strengthen the social safety net. As RESULTS moves into its 2014 campaign, submit an op-ed or letter to the editor to your local newspaper highlighting the success of the War on Poverty and the ongoing opportunities to create economic mobility and help Americans build ladders out of poverty.

Write on Op-Ed on the War on Poverty Anniversary and Expanding Economic Mobility

Use these talking points as a guide to draft opinion pieces on the 50th Anniversary of the War on Poverty:

- This year marks the 50th anniversary of the War on Poverty.

- The War on Poverty was a great success, spawning successful programs such as Head Start, Medicaid, Medicare, and the modern food stamp program (SNAP). As a result, poverty was reduced by almost half between 1960 and 1975.

- If you are able, share how poverty or some of the programs that help families keep out of poverty has impacted your life or those you work with, your family, etc.

- Unfortunately, policymakers have backtracked on the War on Poverty by cutting programs and services in the name of deficit reduction. For example, Congress recently cut SNAP by $8.6 billion in the Farm Bill.

- If we want to end poverty in America, we must support policies that increase economic mobility in America.

- This means helping families earn what they need by expanding the Earned Income Tax Credit and Child Tax Credit, encouraging low-income entrepreneurship through social business development, and increasing the minimum wage.

- This means supporting families as they get on their feet. Instead of allowing key supports such as child care, SNAP, and housing assistance drop off precipitously (the so-called “cliff effect”) at the slightest increase in income, benefits should gradually decrease as a person’s income grows.

- Finally, we need to help families save for the future. Ideas like the Financial Security Credit – a matched savings account for low-income taxpayers – would allow working families to save for financial emergencies and build a better future for their children.

- The War on Poverty has had its victories and its setbacks. Instead of lamenting its shortcomings, I call on our members of Congress to build on its successes and declare a new national commitment to end poverty in the U.S. once and for all.

The War on Poverty 50 Years Later

On January 8, 1964, President Lyndon B. Johnson declared an “unconditional war on poverty.” Building on the success of the New Deal, legislation in response to Johnson’s charge created Head Start, Medicaid, Medicare, the modern food stamp program (now called the Supplemental Nutrition Assistance Program or SNAP), an expansion of Social Security, and the Community Action Program, among others. As a result, in the first ten years of the War on Poverty, the U.S. poverty rate fell by 42 percent. In the decades that followed, the War on Poverty inspired new anti-poverty programs such as the Earned Income Tax Credit, the Child Tax Credit, Early Head Start and the Child Care Development Block Grant. As a result of our efforts to reduce poverty via public policy, anti-poverty programs lifted 41 million people out of poverty in 2012.

On January 8, 1964, President Lyndon B. Johnson declared an “unconditional war on poverty.” Building on the success of the New Deal, legislation in response to Johnson’s charge created Head Start, Medicaid, Medicare, the modern food stamp program (now called the Supplemental Nutrition Assistance Program or SNAP), an expansion of Social Security, and the Community Action Program, among others. As a result, in the first ten years of the War on Poverty, the U.S. poverty rate fell by 42 percent. In the decades that followed, the War on Poverty inspired new anti-poverty programs such as the Earned Income Tax Credit, the Child Tax Credit, Early Head Start and the Child Care Development Block Grant. As a result of our efforts to reduce poverty via public policy, anti-poverty programs lifted 41 million people out of poverty in 2012.

But the work is not done yet. While the poverty rate has not risen to pre-War on Poverty levels, it is still a problem. Currently, about 15 percent of the U.S. population (about 50 million people) lives below the poverty line. Cutbacks on anti-poverty efforts, a changing economy, rising wealth inequality, and economic recessions that hit low-income Americans the hardest deserve the brunt of the blame for the persistence of poverty in America. Unfortunately, some leaders in Washington want to ignore these facts and lay the blame for U.S. poverty on the War on Poverty itself, and are calling for radical changes which could result in millions more Americans in poverty.

The 50th anniversary of the War on Poverty gives us time to celebrate its success and reflect on where we need to do more. Instead of assigning blame where it is not warranted, we must keep moving forward. Recently, World Bank President Jim Kim, who will speak at the 2014 RESULTS International Conference in Washington, DC, June 21-25, announced a goal of ending extreme poverty around the world by 2030. We should follow his lead. Let us build on the successes of the War on Poverty and implement new and innovative ideas that will help us end poverty once and for all in our lifetime.

Sample Op-Ed – Winning the War on Poverty

One of the most powerful advocacy tools at your disposal is the Opinion-Editorial (op-ed). Longer than a letter to the editor, the op-ed gives you the opportunity to expand on your topic and truly educate readers and lawmakers about the issues. We encourage you to take your media advocacy to the next level this month by submitting an op-ed urging Congress to renew our effort to end poverty in America. Submit a piece to your local newspaper, weekly paper, online blog, or other local media source. Work all the media angles to get the word out. If you need help with drafting, editing, or submitting your op-ed, please contact Jos Linn at [email protected] for assistance. Below is a sample op-ed you can use as inspiration or a starting point for your piece.

50 years ago, President Lyndon Johnson declared an “unconditional war on poverty.” We should all be thankful he did.

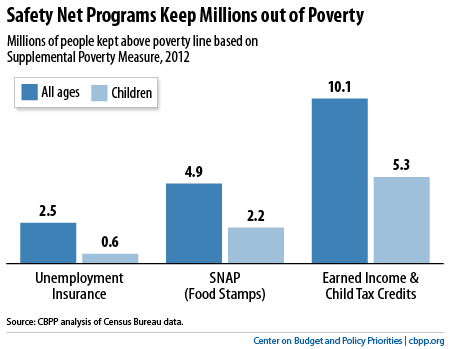

As a result of the War on Poverty, between 1959 and 1975, the U.S. poverty rate was cut in half (from 22 to 11 percent) and has remained well below 20 percent ever since. The programs it created continue to make a difference to this day. According to the Center on Budget and Policy Priorities, anti-poverty programs lifted 41 million Americans out of poverty in 2012. This is a tremendous success and cause for celebration.

But our work is not done. We still have 50 million Americans living in poverty and millions more facing economic uncertainty every day. Instead of solving this problem, too many politicians now use low-income Americans – people who believe in the American Dream just as richly as their wealthy counterparts – to justify dismantling the gains achieved under the War on Poverty. They point to the holes in the safety net as evidence of failure as they hide the shears they used to shred it behind their backs.

The American Dream is slipping out of reach for the majority of Americans. Expanding economic mobility – the ability to improve your lot in life – must be a societal priority if we ever want to be the America we believe in. Fortunately, the task is not as daunting as it seems. Here’s how we can do it.

First and foremost, we must ensure that low-income Americans can earn what they need to make ends meet. As President Obama said in his recent State of the Union speech, “no one who works full time should ever have to raise a family in poverty.” Unfortunately, for millions of working Americans, work and poverty go hand-in-hand. Congress should expand the Earned Income Tax Credit and Child Tax Credit, which enabled 9.4 million people to pull themselves out of poverty in 2012. We should also help struggling Americans become entrepreneurs by investing in social business through the Social Innovation Fund, and raising the minimum wage would certainly help.

We must also update programs to support low-income families as they get on their feet. Far too many working families are being punished for achieving success. Right now, many programs automatically terminate when a family receives a modest (and much-earned) increase in income. As a result, they lose far more than they gain. A raise should be an incentive to earn more, not the catalyst for falling deeper into poverty. To remedy this, we must re-grade this “cliff” effect into a slope so that public benefits decrease gradually in proportion to a family’s financial success.

Finally, if we truly want to win the War on Poverty once and for all, we must help people save for the future. Data released by CFED last month shows the percentage of households in the US who lack the savings needed to weather a financial storm like a job loss or medical emergency (called “asset poverty”) is 25 percent, and it rises to an astounding 44 percent if you only count “liquid” assets (assets that can be converted to cash fairly quickly). We should all be very concerned if almost half of us are on the brink of financial calamity. Savings provides a cushion for families when these financial crises arise. We spend hundreds of billions of dollars each year promoting asset building through various tax breaks, but they primarily benefit people who already have wealth. Our goal should be to support people to build wealth; not simply reward those who already have it. The Financial Security Credit, which uses the tax code to create matched savings accounts for low-income taxpayers, would help struggling families save so that when disaster strikes, they would have their own personal safety net to fall back on.

If the Great Recession taught us anything, it is that no one is immune from financial catastrophe. The 50th anniversary of the War on Poverty gives us the perfect opportunity to reflect on its success, correct what didn’t work, and move forward. I call on all our elected officials to follow World Bank President Jim Kim’s call to end poverty by 2030 and renew our commitment to America’s families by building newer and stronger ladders out of poverty. When families can earn what they need, stay on their feet, and save for the future, the American Dream will no longer be out of their reach.