The "One Big Beautiful Bill" Act reconciliation package: What happened, where did it land

Congress passed the “One Big Beautiful Bill” Act (OBBBA) reconciliation package on July 3, 2025. OBBBA transfers much of the cost of programs for basic human needs to states. States cannot afford this. This means deep cuts to healthcare (Medicaid) and food assistance (SNAP). Millions of children are still left out of the Child Tax Credit—the children who already have the fewest resources. Prejudice and oppression are codified into this law. But there is time before these cuts happen, and there are many ways to push back. (See this helpful timeline for when OBBBA’s parts take effect).

You mounted an exceptional advocacy campaign to fight this damaging law. While OBBBA’s passage is a blow, your advocacy grew crucial relationships with lawmakers. You tangibly helped dial down the harm this bill could have caused (see the July 3rd entry below for how). This is not the end, it’s the sign to keep building our power and keep fighting.

Reconciliation is a special process for passing legislation without a large majority in Congress

Reconciliation is a special legislative process for legislation impacting federal spending and revenues. It allows the Senate to bypass the filibuster. A filibuster is where just one Senator can stop a bill from passing. Normally, the Senate needs a large majority of 60 votes to stop a filibuster. This means the Senate can pass a reconciliation bill with a simple majority of only 51 votes. When one political party controls the House, Senate, and White House, lawmakers use reconciliation. This way, they can pass budget bills without interference from the other party. Past examples include the Affordable Care Act (2010), and the Tax Cuts and Jobs Act (or the Trump Tax Cuts of 2017).

Reconciliation gives Congress a quick way to address national priorities. Issues like taxes, spending, and the debt limit can use reconciliation. The first step is for the House and Senate to both pass the exact same “budget resolution”. The budget resolution is a “blueprint” for congressional committees. Committees must meet certain spending or revenue levels for programs under their jurisdiction. These instructions are usually vague and non-binding.

Once the House and Senate pass the budget resolution, the committees write the details of the legislation. Once the committee agrees on its plan, it “passes out of committee.” All committee plans then become one bill. The House and the Senate each debate and vote on their respective reconciliation bills. Sometimes there are differences between the House version and the Senate version. Congressional leaders work them out and a final bill goes back to the House and Senate for a final vote. If it passes, the bill goes to the President for a signature. Our friends at the Center for Budget and Policy Priorities (CBPP) also provide a more full explanation of the process.

Latest updates

The House just passed the Senate version of the budget reconciliation bill by a vote of 218-214. There’s no sugarcoating: this is devastating. The damage will impact our economy and communities for years to come. Believe it or not, we also prevented or mitigated some damage with our advocacy. Read on to see how. But here are some of the harms we can anticipate:

- As many as 20 million will lose all or part of their health coverage or food assistance.

- Many rural hospitals could close due to changes in the Medicaid provider tax.

- Former foster youth, veterans, and those surviving homelessness will have harsh new work reporting requirements to receive nutrition assistance. This will end benefits for many.

- Over 17 million children will remain locked out of the full Child Tax Credit (CTC) because their parents do not get paid higher wages.

- Immigrant families will be targeted in several ways. They will lose access to many benefits. There will also be more funding for cruel (and often unlawful) mass deportation efforts.

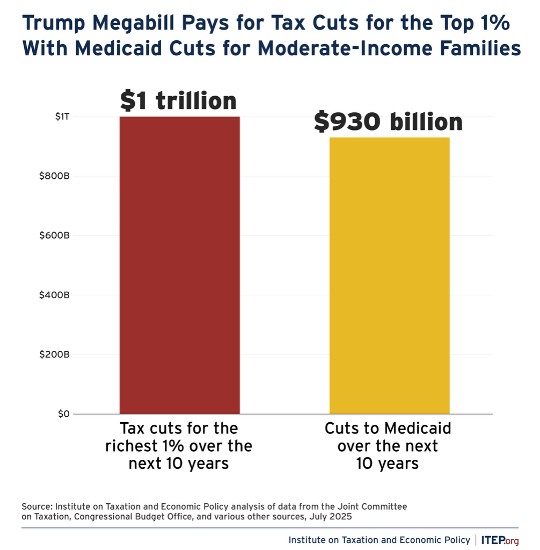

All of this damage serves the purpose of handing trillions in tax breaks to the wealthiest in our country. The national debt will explode to the tune of $3.3 trillion (or as high as $6 trillion according to some estimates). Many have called this the largest transfer of wealth from everyday people to the rich in U.S. history. The top 1 percent of earners alone will rake in $1 trillion in tax cuts.

But, it is important to also recognize the impact of your advocacy. For instance, there were a few positive changes in the Senate bill for which RESULTS advocated. Here’s where your advocacy made a difference in the final bill:

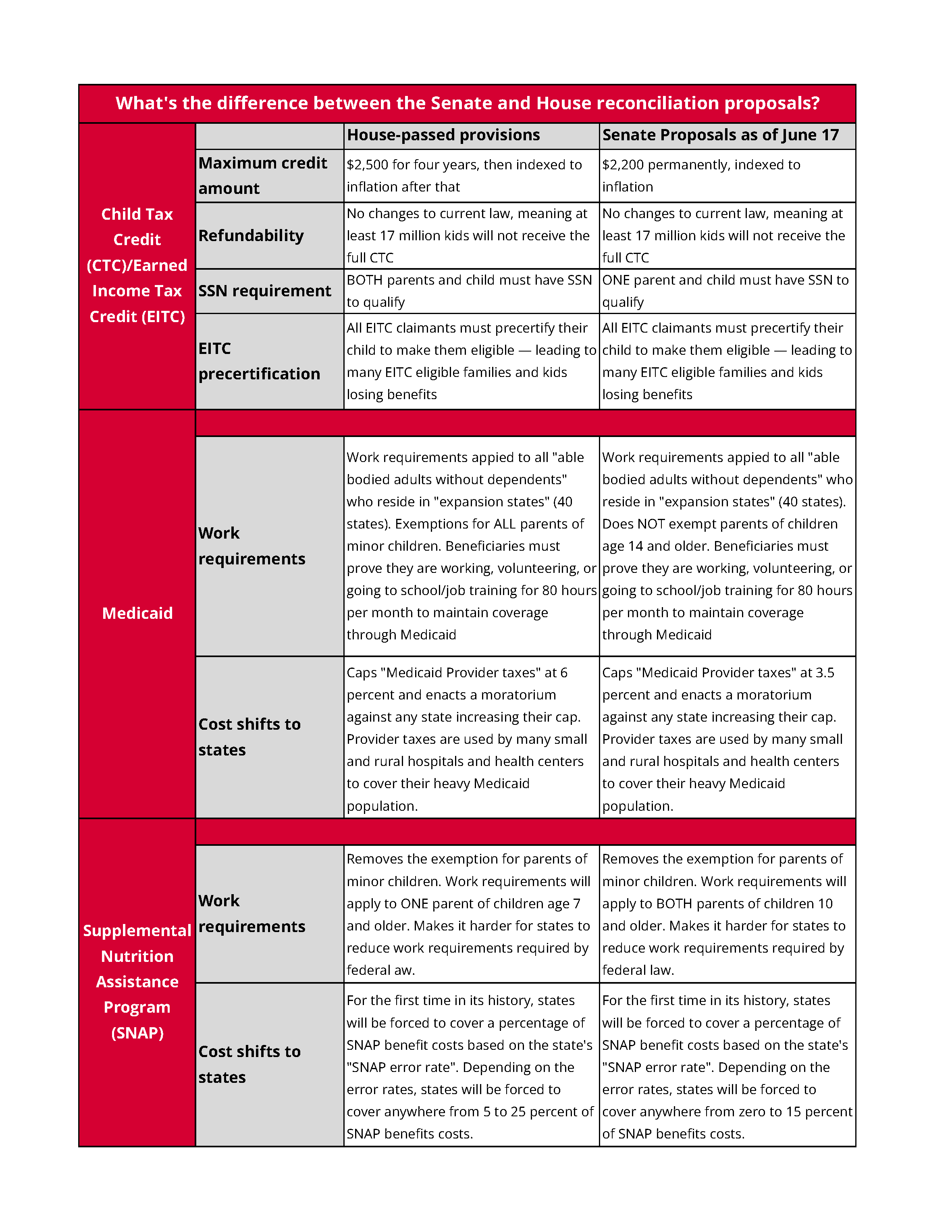

- Reduced the state cost sharing mandate in the Supplemental Nutrition Assistance Program (SNAP). The House bill ranged from 5 percent to 25 percent cost-sharing while this final bill is zero to 15 percent.

- Increased the age at which new work requirements would apply to adults with children from ages 7 to 10 (still horrible, but slightly less bad).

- Removed an onerous new “pre-certification” process for the Earned Income Tax Credit. The House-passed bill would have required parents to pre-certify their children BEFORE they could file their taxes.

- Changed a Social Security requirement that would have removed 4.5 million U.S. citizen kids from CTC eligibility. It would have required both parents to have a social security number (SSN). The final version only requires an SSN for one parent. Still awful, but 2 million more kids will be eligible for the CTC by comparison.

To be clear, even with these small positive changes, the bill remains terrible. But we can reflect on small victories. We must remind ourselves that our action can move the needle, even if it’s sometimes only slightly. This reconciliation bill will be signed into law on July 4.

Many of you likely wonder what comes next. Read the RESULTS statement on the passage of the bill and the pivot to accountability. As we rest and mourn, we must also tell Congress that we will not forget or back down. Write about what happened here in the media, call out your members of Congress by name to thank them or hold them accountable. Use this action alert to send a tailored message to your lawmakers depending on how they voted.

Finally, thank you for all you’ve done so far in 2025. It’s been a difficult year for the fight against poverty. Community and solidarity make it possible to continue. And continue we will.

The Vice President cast the deciding vote to allow the Senate to pass its version of the reconciliation bill. After the longest EVER vote-a-rama, the Senate clocked in with a vote of 50-50. The Vice President’s tiebreaker brought the final vote to 51-50 in favor. Senators Collins, Paul, and Tillis joined all the Democrats and voted “no”. Senator Murkowski flipped at the last hour to a “yes” vote which allowed the passage of the bill. See the RESULTS statement on the Senate bill.

The fact that the vote was so close is testament to your hard work and advocacy opposing this harmful legislation. That lawmakers were crossing party lines to vote against it is also proof of how damaging this bill would be.

But it isn’t over yet! The House Rules Committee will meet this afternoon (July 1) to start consideration of the Senate bill. The Senate bill is very different from the House bill. This means that there must be some negotiations on how to reconcile the differences. Remember, for reconciliation to work, both chambers of Congress must pass identical bills. The majority House and Senate leadership are working on that as you read this now. We expect the House to vote tomorrow, Wednesday, July 2.

Many House members that RESULTS volunteers spoke to told us that the Senate would fix the bill. But instead, they made it worse.

Now is the time to write to your House offices and tell them to reject this horrible bill. Tell them how it takes food assistance away from foster kids, veterans, and people surviving homelessness. Tell them it will bankrupt your state government by shifting the costs of Medicaid and Supplemental Nutrition Assistance Program (SNAP) to your state budget. Tell them about the millions who will lose health insurance.

Let them know you’re paying attention to what’s happening in your community and in our government.

We reported in our June 6 blog update below about the horrible details of the House-passed reconciliation bill. In the two weeks since then, the Senate has been rushing to draft their own version of the reconciliation bill. We now have proposed text covering our priorities in the Senate. Bottom line: the Senate proposal is no better than the House’s. In some ways, it’s worse. See the key differences between the two versions in the chart below.

RESULTS’ opposition to the bill remains absolute. Over the next few weeks, the Senate will try to finalize a bill that can pass both chambers. The bill must also go through a process called the “Byrd bath.” During this procedure, some provisions in the bill may be struck down if they do not adhere to Senate rules on reconciliation bills.

The Senate’s goal is to vote on the final package in the Senate by July 4. That means now is the time to contact your Senators. Educate them on the dangers of this bill and urge them to vote NO.

Note that if the Senate passes the bill, the House will have to vote to approve the Senate changes. After contacting your senators, follow up with your representatives. Urge them to vote NO on whatever the Senate sends them. Many RESULTS volunteers were told their Republican representatives voted YES assuming the Senate would “fix” the House bill. They were wrong. Let them know the Senate didn’t fix anything and that you expect them to vote “no” accordingly.

For offices supportive of our priorities, it is helpful to share all the media you have published. You can also send any media stories about how Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and the Child Tax Credit (CTC) help you, your family, or your community. Local stories about the impact this bill will have on communities are a critical line of defense. For offices who may support the reconciliation bill, RESULTS staff is on standby. We will help with targeted messages for your Senators, so please contact us for assistance.

Finally, any of the improvements to the bill that the Senate made were due in part to YOUR advocacy. There were improvements in the proposed SNAP work requirements and state cost-sharing. There was also better CTC eligibility for mixed status families. None of this would have happened without your advocacy, so thank you!

Recently the House narrowly passed their version of the budget reconciliation bill. The budget reconciliation is a process Congress uses to fast-track passing a bill. This avoids the filibuster in the Senate. But a reconciliation bill only requires a simple majority in BOTH chambers.

Republicans are using the reconciliation process to easily pass a bill without votes from Democrats. This “one big, beautiful bill” contains many elements of President Trump’s policy agenda. The bill makes significant changes to federal tax policy. It also makes drastic cuts and changes to federal anti-poverty programs and services. Included in the chopping block are federal health and nutrition assistance programs.

These cuts will harm our communities and future generations.

As a reminder, Congress narrowly passed a resolution in early April to unlock the budget reconciliation process. It provided instructions to key congressional committees to change federal tax law. The resolution also makes drastic cuts of at least $1.5 trillion to many anti-poverty programs. These programs include the Supplemental Nutrition Assistance Program (SNAP) and Medicaid.

Below is an update on the reconciliation process and the next steps we’ll take to fight against these cuts.

The House already passed a version of the bill. It slashes funding for many anti-poverty programs. But RESULTS advocates helped narrow the final vote in support of this bill.

On May 22, the House passed their version of the budget reconciliation. This takes it one step closer to becoming law. The bill passed very narrowly — 215-214 — along party lines.

Just before the House voted, twelve RESULTS grassroots volunteers flew to Washington, D.C. They spoke to their lawmakers about how harmful this bill would be to their communities. Advocates were able to meet with nearly 30 legislative offices. They held a handful of face-to-face meetings. Some met directly with their members of Congress. You can read more information about their journey to D.C. here.

The ultimate House vote did not stop this bill from passing. But advocates were able to showcase their power and educate offices about the devastating impacts of this legislation to their states and local communities. The final vote margins could have been bigger. But we successfully prevented this outcome. Thanks to your ongoing outreach and persistent advocacy.

Policies in the House bill will worsen poverty in the United States.

The House package includes several controversial measures. They would deeply cut into two of the nation’s key safety net programs — Medicaid and SNAP. While making permanent essentially all of the trillions of dollars of individual income tax breaks contained in the 2017 Tax Cuts and Jobs Act. Details about the House bill are available here. Below is a quick summary of what the House bill does to RESULTS’ policy priorities.

Changes to Medicaid – expanded work requirements

- More people will soon lose their health insurance coverage. Certain recipients ages 19 to 64 would be required to work at least 80 hours a month to retain their benefits. This would be a first in Medicaid’s 60-year history. This work requirement would take effect by the end of 2026. The mandate would not apply to parents, pregnant women, medically frail individuals and those with substance-abuse disorders, among others. However, these populations would be devastated. More health facilities would either close or reduce services due to lack of Medicaid funding.

- Medicaid recipients would be required to go through more bureaucracy. The package requires states to check Medicaid expansion enrollees’ eligibility every six months. This is instead of doing it annually. It will also require certain low-income adults covered under the Medicaid expansion to pay for a portion of their care. It requires proof of U.S. citizenship or legal immigration status.

- States will be punished for expanding Medicaid coverage for their constituents. The bill punishes states that have expanded Medicaid. It also punishes states that use state funds to provide Medicaid coverage to undocumented immigrants. These states would see a 10 percent reduction in their federal matching funds for the expansion population. Several states, like California, New York, Utah, and Illinois, cover undocumented people in state health plans. The bill will codify changes to the Affordable Care Act enrollment process. This includes President Trump’s proposal to shorten the open enrollment period. The bill will also eliminate the ability of low-income Americans to sign up for coverage year-round.

Changes to SNAP – cost-shifting to states and expanded work mandate for food stamps

- Work requirements will be expanded for the nutrition assistance program. Currently, adults ages 18 to 54 without dependent children can only receive food stamps for three months over a 36-month period unless they work 20 hours a week or are eligible for an exemption. The legislation would extend the work requirement to those ages 55 to 64. It will also extend to parents of children between the ages of 7 and 18. Plus it would curtail states’ ability to receive work requirement waivers in difficult economic times. This limits the waivers only to counties with unemployment rates above 10 percent.

- Cost-burdens will be shifted to states. The bill would also require states to pay for a portion of the benefit costs — at least 5 percent — for the first time, starting in fiscal year 2028. States with higher payment error rates would have to shoulder more of the burden — as much as 25 percent of the costs for those with error rates of at least 10 percent.

- More people will lose access to SNAP. Due to these proposed changes, SNAP recipients could lose crucial food assistance. States would be on the hook for millions of dollars. States would need to offset these costs. And that could lead them to further cut benefits and eligibility for other public services programs.

Changes to federal tax policy – larger child tax credit but not for those in poverty, while excluding others who would still be eligible

- Higher income households will get bigger tax benefits. The child tax credit would rise to $2,500, up from $2,000, per child from 2025 through 2028. Single parents earning up to $200,000 and married couples earning up to $400,000 qualify.

- Two million fewer children would be eligible next year. The bill would require that parents, in addition to the child, have Social Security numbers in order to be eligible. Currently, parents can claim the credit if they have individual taxpayer identification numbers. This bill would exclude eligible U.S. citizen children whose parents are noncitizens and without Social Security numbers.

This is not a done deal. RESULTS advocates must tell Senators: no cuts to critical anti-poverty programs to fund tax cuts for wealthier people and businesses.

After squeaking through the House by a single vote, the bill now moves to the Senate. It is expected to undergo substantial revisions to comply with the chamber’s reconciliation rules. It needs to gain enough support from lawmakers to pass.

We have a narrow window to influence Senators, who are not in agreement with what should go in the bill. Some want more, deeper cuts to anti-poverty programs. While others are worried about how the House bill will harm their communities. Right now, the Senate has an ambitious plan to pass the budget reconciliation before the 4th of July recess. But, this timeline may get pushed back to the August recess. Nevertheless, our messaging remains the same:

Congress should not cut vital health and nutrition programs to give tax breaks to wealthier Americans and corporations.

Click here for current congressional leave behinds.

- Supplemental Nutrition Assistance Program (SNAP) and Medicaid: SNAP helps 40 million people each month put food on the table. Medicaid provides health coverage for nearly 80 million Americans who cannot afford it. Both programs are vital to keep people healthy and fed. This also includes rural communities who see the worse impacts. When talking to Congress, it is important to discuss the need to protect these services. The cuts would completely gut these programs and create more harm.

- Child Tax Credit (CTC) and Earned Income Tax Credit (EITC): The Tax Relief for American Families and Workers Act would have expanded the CTC. This would have helped 16 million kids from families earning low wages. Five hundred thousand people would have the tools to lift themselves out of poverty. Congress should pass similar legislation without decreasing the EITC or making cuts to vital programs.

Congress is in a rush on reconciliation because it contains an increase to the debt ceiling. There is a hard deadline for the debt ceiling.

The reconciliation bill includes an increase in the national debt limit. The government takes on debt to pay for critical programs (SNAP, Medicaid, etc.). The debt also funds other government functions (military, national security, etc.). Congress must increase the debt limit as prices increase, and more people use these services. If Congress does not increase the debt limit, the government will default on its debt. This could cause economic chaos, in an already fraught economic environment. The estimated date for the government to hit the debt ceiling is sometime this August. RESULTS is monitoring debt ceiling movements and its impact on the reconciliation bill.

Recently, Congress passed a budget resolution unlocking the reconciliation process. This resolution provides instructions to make drastic cuts to vital U.S. health and nutrition programs.

These cuts will harm us, our communities, and future generations who depend on these services.

Below is an update on the reconciliation process and the next steps we’ll take to fight against these cuts.

Right now, congressional Republicans have a reconciliation plan in place that makes devastating cuts. If they can agree on details, they could pass it.

Congress narrowly passed a budget resolution to start the reconciliation process. Republicans control both the House and Senate. Reconciliation bills cannot be filibustered. This allows Republican leaders to pursue cuts to services without needing any votes from Democrats. The budget resolution proposes at least $1.5 trillion in cuts to vital health and nutrition programs. Republicans are currently clashing over the severity of the cuts. However, they may still be on track to pass a final bill in late May to mid-June.

The proposed cuts are as follows:

- Agriculture (SNAP is here) - $230B

- Education and Workforce (WIC, TANF, and Head Start are here) - $330B

- Energy and Commerce (Medicaid is here) – $880B

- Financial Services (most of Housing is here) – $1B

- Natural Resources - $1B

- Oversight and Government Reform – $50B

- Transportation and Infrastructure – $10B

- Unspecified committee - $500B

The GOP would also include its tax priorities. We as anti-poverty advocates hope they will include expansions to the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). Congress can fund these expanded tax credits without cutting other tax credits or anti-poverty programs. But, congressional Republicans may try to fund these tax credits with cuts to U.S. health and nutrition programs. Funding tax credits by tanking other anti-poverty services would leave struggling families and individuals far worse off.

RESULTS advocates must tell legislators: no cuts to critical anti-poverty programs to fund tax cuts for wealthier people and businesses

Our messaging remains the same:

Congress should not cut vital health and nutrition programs to give tax breaks to wealthier Americans and corporations.

Click HERE for current Congressional leave behinds.

- Supplemental Nutrition Assistance Program (SNAP) & Medicaid: SNAP helps 40 million people each month put food on the table. Medicaid provides health coverage for nearly 80 million Americans who cannot afford it. Both programs are vital to keep people healthy and fed. This also includes rural communities who see the worse impacts. When talking to Congress, it is important to discuss the need to protect these services. The cuts (see list above) would completely gut these programs and create more harm.

- Child Tax Credit & Earned Income Tax Credit: Congress should revisit last year’s bipartisan tax relief legislation. The Tax Relief for American Families and Workers Act would have expanded the CTC. This would have helped 16 million kids from families earning low wages. Five hundred thousand people would have the tools to lift themselves out of poverty. Congress should pass similar legislation without decreasing the EITC or making cuts to vital programs.

Congress is in a rush on reconciliation because it contains an increase to the debt ceiling. There is a hard deadline for the debt ceiling.

The reconciliation bill includes an increase in the national debt limit. The government takes on debt to pay for critical programs (SNAP, Medicaid, etc.). The debt also funds other government functions (military, national security, etc.). Congress must increase the debt limit as prices increase, and more people use these services. If Congress does not increase the debt limit, the government will default on its debt. This could cause economic chaos, in an already fraught economic environment. The estimated date for the government to hit the debt ceiling is sometime this summer. RESULTS is monitoring debt ceiling movements and its impact on the reconciliation bill.

Current timeline for passage of reconciliation (location of RESULTS’ priorities)

Week of April 28:

- Congress returns from recess

- House begins markup bills of reconciliation in the Judiciary, Homeland Security, and Armed Services committees (No RESULTS priorities here)

Week of May 5:

- May 5: House Energy & Commerce (RESULTS’ Medicaid priorities) and Agriculture (RESULTS’ SNAP priorities) committee markups

- House likely to vote on recissions package

- Senate committees begins releasing their plans for cuts

Week of May 12:

- May 16: House appropriations requests deadline (RESULTS’ global poverty priorities)

- House Ways & Means Committee markup (RESULTS’ tax priorities)

Week of May 19:

- House likely to vote on reconciliation

Week of May 26:

- Memorial Day recess

June 16:

- Senate likely to vote on reconciliation bill

Right now, there is a budget reconciliation process underway that would cut critical U.S. anti-poverty programs

Republican leadership in the House and the Senate want to use reconciliation. But the Senate and the House don’t yet agree on the best path forward. The Senate passed a smaller budget resolution on February 21. They hope to later pass a second one on tax policy. The House prefers “one big, beautiful bill” (in the words of President Trump). The larger House budget resolution passed on February 25. Since they are not identical, the two chambers now must agree on a unified budget resolution to move forward.

Both budget proposals contain cuts to key anti-poverty programs like SNAP and Medicaid. As advocates, we must focus on protecting these programs.

Republicans in both chambers want to make tax cuts passed in 2017 permanent. These tax cuts primarily helped the wealthy. They hope to pay for part of these tax cuts by cutting Medicaid and Supplemental Nutrition Assistance Program (SNAP) funding. For example, the House budget resolution requires $880 billion in cuts from the committee overseeing Medicaid. It also calls for $230 billion in cuts from the committee governing SNAP. Food assistance and health care access would evaporate for millions. Poverty would skyrocket. All to make the rich richer.

We must protect and grow the tax credits that are vital tools for surviving poverty

During the first Trump Administration, Congress increased the Child Tax Credit (CTC) from $1,000 to $2,000. Unfortunately, they did not provide the credit to more families working in low wage jobs. It’s likely that Republican leaders will try to make these changes permanent with reconciliation. This is unacceptable. If permanent, this CTC will continue to leave 17 million kids out of the full credit because their parents don’t earn enough.

Thankfully, there is some bipartisan consensus that the CTC should improve. Vice President Vance and Sen. Josh Hawley (R-MO) have suggested the CTC should reach more families who work in low wage jobs. This bipartisan support is crucial for our advocacy. However, other Republicans suggest financing a better CTC with cuts to another important tax credit, the Earned Income Tax Credit (EITC). The EITC provides support specifically to families and individuals with low incomes. Cutting the EITC to fund the CTC is not okay. We must not fund anti-poverty programs by cutting other anti-poverty programs.

The RESULTS leave behind, policy brief, and laser talk have more on advocating for tax credits.

Medicaid is at risk in reconciliation legislation. We need to defend it.

Medicaid is a state and federal partnership that funds health care for nearly 80 million people facing poverty. It covers health care for 54 million older adults, children and people with disabilities (see Medicaid data at the state and congressional district level). It is a lifeline for these individuals who otherwise would not be able to afford health care coverage. See the RESULTS one-page Medicaid explainer.

Currently, the federal government pays for roughly 70 percent of Medicaid costs. Some Republicans in Congress now want to cap the amount of funds provided to states for Medicaid. This will force states to increase funding to maintain Medicaid or cut benefits and/or eligibility. (See state Medicaid fact sheets from Kaiser Family Foundation).

There are also proposals to increase onerous work reporting requirements. These reporting requirements are not to increase employment. Instead, they will kick people off Medicaid. In 2018, Arkansas enacted work reporting requirements for Medicaid. In the first seven months, one out of four Medicaid recipients subject to the new requirements lost coverage. Congress must not repeat Arkansas’ mistake.

We must tell Congress: don’t cut Medicaid. Fortunately, lawmakers on both sides of the aisle are speaking out in defense of Medicaid. We must amplify these messages. We must tell our lawmakers to oppose legislation that takes health care away from families.

We must also demand that Congress does not take money from SNAP to fund tax cuts for wealthier people

SNAP helps 40 million people per month buy food. Nearly half of those recipients are children. Usually, Congress addresses SNAP through recurring legislation called the Farm Bill. Right now though, Congress is trying to use reconciliation to cut SNAP and fund tax cuts for wealthier Americans.

It is unclear exactly how Republicans would cut the $230 billion in food assistance that the House budget resolution demands. (See State fact sheets on SNAP from Food Research and Action Center). There are proposals for more work requirements and changing eligibility (and more). None of these are acceptable.

The overall message: Improve the CTC and don’t cut SNAP or Medicaid

This update provided a lot of information about several programs. But there is really one message on reconciliation: “improve the CTC and don’t cut Medicaid or SNAP.” This is our ‘ask’ for Congress and in the media. Tell them how it will affect your community. Together, we will raise our voices!

Thank you for all you do!