How to respond to common arguments against expanding the Child Tax Credit (CTC)

We’ve all been there. You’ve worked with your member’s office to schedule a meeting. You’ve done lobby prep with RESULTS staff and created a detailed meeting agenda with your local group. You’ve researched your policymaker, checked out policy and lobbying resources on RESULTS’s website. You’re ready to share your own lived experience with a policy and how it affects your community. Then, in your meeting, the lawmaker or aide shares some very specific pushback against your request. What do you do?

This can feel pretty scary in a lobby meeting, and I have been there personally many times. I’ve heard that most recently, advocates have gotten pushback on expanding the Child Tax Credit (CTC) — even though the CTC contributed to a staggering 46 percent drop in child poverty. Now, 19 million children from the lowest-income families do not receive the full CTC, and millions are struggling without monthly CTC payments for food, housing, medical care, and other basic needs. So, I decided to write this blog to help you dispel myths and pushback you may encounter when lobbying for expanding the CTC.

Over the last year, lobby reports have indicated the following three myths come up as pushback against the CTC: 1) the CTC disincentivizes work; 2) the CTC is partisan; and 3) the CTC is too expensive.

Here are some resources and pointers to help you respond to these common arguments against expanding the CTC. But remember, you know your representatives the best and therefore know what arguments will resonate with them the most.

Myth #1: The CTC disincentivizes work.

This is by far the most common argument from conservatives. Just this week, Chairman of the House Ways and Means Committee Rep. Jason Smith issued this opening statement saying, “we must reconnect the CTC to work” and that “work should pay better than sitting at home.” To try to support this point, many offices will bring up a single study from the University of Chicago that predicted 1.5 million single mothers would leave the workforce due to CTC expansion. This study was a projection based on a deeply flawed design. While economic modeling is often helpful when designed well, we actually now have an avalanche of real world evidence from the 2021 CTC expansion showing that it did not disincentive work at all. Expanding the CTC does not lead to people working less — that’s a fact substantiated by data.

But data only go so far to refute the flawed University of Chicago Study — lived experience speaks volumes. I have often shared about the 4 years of my life where I stayed out of the workforce because of childcare costs, and how the CTC could have allowed me to go to work, contribute to my local tax base, and save for retirement. While you may not have this exact experience, search for ways to connect the CTC to your ability to work or to its implications for your community. Our personal stories are our best arguments.

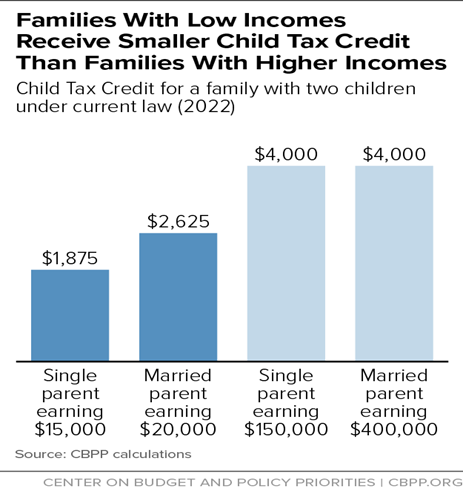

This is also where researching your member of Congress comes in handy, because many lawmakers’ values align with the expanded CTC even if they do not yet support it. Take Rep. Smith and his statement above against the CTC. He also said he wants to “deliver tax relief for families” and “put the interests of working-families first.” Since the 2021 expansion lapsed, working families with lower incomes lost much of their CTC support. For example, a household earning $20,000 per year (which is $5,000 more than a full-time worker at federal minimum wage) receives just 65 percent of the value of the CTC. This does not seem like “putting the interest of working families first.” For Rep. Smith, the best way to live out his purported values for working families would be to support an expanded CTC.

Myth #2: The CTC is partisan.

If your member says that the CTC is partisan, I encourage you to highlight the long history of bipartisan CTC expansions. You can even remind them that the original CTC passed in 1997 under a Republican-controlled Congress and was expanded by Republicans multiple times. There is also bipartisan consensus that elements of the 2017 Tax Cuts and Job Act (TCJA) could be improved. For instance, the TCJA included several corporate tax breaks that already have or will expire. It also increased the CTC credit amount from $1,000 to $2,000 — but did little to expand the credit families with little to no taxable income. There is bipartisan support to both reinstate the corporate tax breaks as well as expand the CTC so that it includes more families with lower incomes. Letting lawmakers know that this bipartisan support exists in the context of TCJA can help break down some deep partisan divides for the CTC.

Myth #3: The CTC costs too much.

This argument springs from the 2021 expansion which costs around $100 billion per year. We are in favor of that policy, and we should not shy away from the larger vision of a permanent CTC that is money well spent to support children’s well-being and stimulate the economy. But at the same time, there are other effective ways to expand the CTC in the short term that do not cost nearly as much. For instance, keeping the current credit amount, but making the credit “fully refundable,” (meaning it includes families with little to no taxable income) only costs $16 billion per year. There are many ways that we can improve the CTC that wouldn’t cost $100 billion per year. Ask your member what their ideas are for expanding the CTC, particularly if they’ve expressed interest, but cited cost as their concern.

Progressive pushback and building bipartisan bridges

“Go talk to Republicans” is a common refrain from frustrated progressive CTC supporters in Congress. Many feel that due to partisan rancor, there’s nothing they can do. You can flag that RESULTS volunteers are talking productively to Republican offices, and they should too. Use the talking points above to remind them that the CTC actually has a history of bipartisan support so there is already common ground.

As an advocate, you can also help move a supportive member of Congress up the CTC champion scale! Even though there is not current legislation pending for them to vote on, they can uplift the CTC in social media or write letters to the editor and op-eds. You can even have your group draft an op-ed for a lawmaker’s office to review and co-author with you (our local Indiana group did this and you can see the results here).

What I have shared in this blog is by no means an exhaustive list of all the CTC myths, pushback, or ways to refute them. I am always happy to talk to you about your lawmakers and advocacy. You can also check out this blog on conservative messaging about the CTC. Remember, you know your member best and should always go with your instinct on what arguments will resonate with them the most.