Ending Child Poverty is a Policy Choice

According to 2018 census data, nearly 12 million children in the United States live below the federal poverty line, including 2 out of 3 children of color. These numbers are astonishing, especially because we know how harmful poverty can be on the long-term outcomes of children’s lives. Poverty decreases a child’s chances of graduating high school, and, in turn, increases the likelihood of making lower wages in adulthood. Moreover, children living in poverty are more likely to suffer from mental illness and other detrimental impediments to their growth.

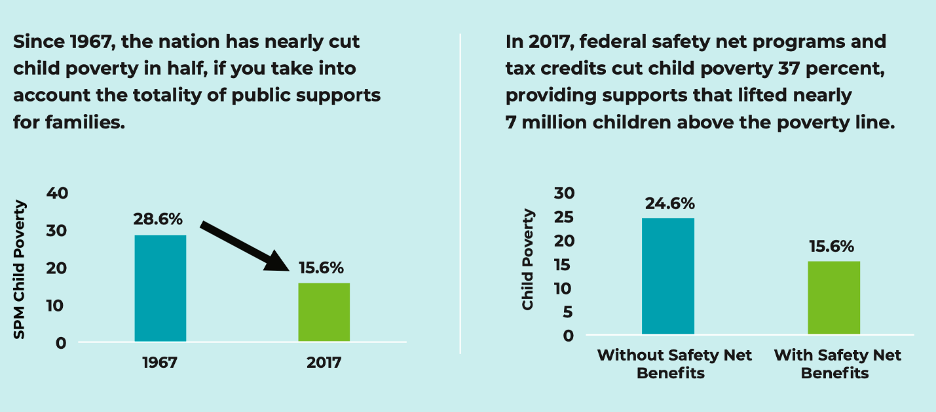

Luckily, we know that anti-poverty policies do make an impact on child poverty, as shown below:

In response to a request from Congress, the National Academies of Science, Engineering, and Medicine produced a report in 2019 outlining packages of policies that could cut child poverty by 50 percent over the next decade, while increasing employment and earnings among low-income adults at the same time.

In addition, when looking at a series of proposals from Children’s Defense Fund outlined in this 2019 report, the Urban Institute found that, if enacted, the CDF plan would reduce child poverty by 57 percent and Black child poverty by 65 percent, thus lifting 5.5 million children out of poverty and improving the economic circumstances for 95 percent of all poor children if the United States. The Urban Institute found that a combined package of improved EITC, housing assistance, and SNAP would decrease child poverty by 45 percent at a cost of $51.5 billion. In fact, if the United States adopted all the policy proposals set forth by the Children’s Defense Fund and immediately invested an additional 1.4 percent of our federal budget into existing programs and policies, we could lift 5.5 million children out of poverty and improve the economic circumstances for 95 percent of all poor children in the United States.

To be clear, the United States already spends nearly $700 million in lost productivity and increased health and crime costs associated with the negative impacts of poverty on children each year. Strengthening our financial commitment to the well-being of our children early on to negate these impacts would be both the correct moral and fiscal thing to do. In this blogpost, we take a closer look at the housing, federal nutrition, and tax policies that could greatly reduce child poverty.

The Impact of Providing Housing Assistance

Safe, affordable housing is a basic human right essential for a child’s mental, physical, and emotional development. Today, it is estimated that nearly 1 in 3 Americans are housing cost-burdened, meaning that more than 30 percent of a family’s income is spent on housing. According to Habitat for Humanity, these numbers add to approximately 20.5 million renters and 17.3 million homeowners. Because only 1 in 4 eligible households receive federal housing assistance, millions of low-income children and their families receive no housing assistance from the government, leaving over 22 million children live in extremely cost-burdened (over 50 percent of household income spent on housing costs) households, as of 2018.

There are a few policy solutions that Congress and the federal government could pursue to ensure that families live in affordable, safe, and stable homes. For example, Columbia researchers found that making housing vouchers available to everyone that qualifies for them would drop the poverty rate by 22 percent, and child poverty by 34 percent. Another avenue to increase the supply of affordable homes for low-income renters could be in the form of a renters’ tax credit, which Columbia University researchers estimate could lift over 9 million Americans above the poverty line. Children’s Health Watch estimates that healthcare costs related to unstable housing conditions would cost us $111 billion over the next ten years, which means that keeping a roof over children’s heads improves not only the health of individual children, but the overall economy.

The Impact of Tax Credits on Low-Income Americans

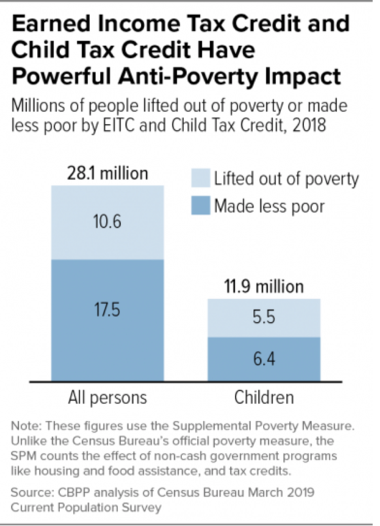

In 2018, 4.7 million children were lifted out of poverty with the combined help of Earned Income Tax Credits (EITC) and the Child Tax Credit (CTC). However, many children were completely left behind due to inadequate funding, eligibility requirements, and low wages.

We know that children receiving EITC benefits show higher scores on reading and math exams and are more likely to go to college and have higher earnings as adults. EITC also stimulates the local economy, as research shows a $1.50–$2.00 return to the economy for every EITC dollar a worker earns. Increasing EITC’s value and phase-in rates would better serve families with low incomes while widening eligibility to include workers who do not claim dependents but still care for children—including noncustodial parents—and benefit the large number of children who are cared for by family friends, grandparents, or extended family.

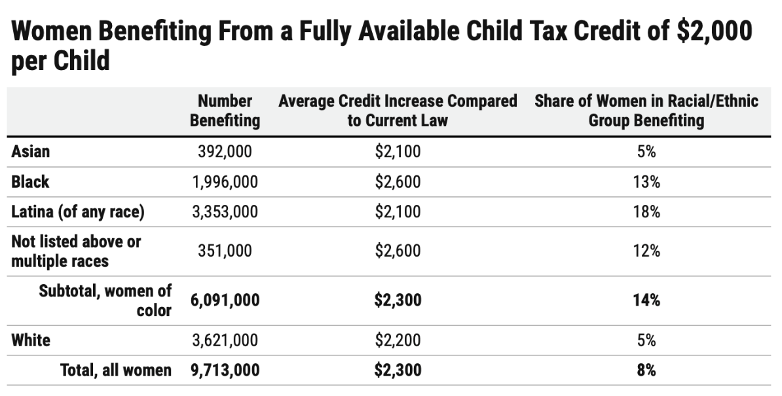

Another refundable tax credit that enhances the quality of life for children is the Child Tax Credit. In 2018, the Child Tax Credit (CTC) lifted 2.3 million children out of poverty and reduced poverty for 5.8. million more. Yet nearly 23 million children, especially children of color, miss out on these benefits. Approximately Changing CTC to a fully refundable tax credit would increase its reach to millions of children because it would no longer be tied to an income requirement. The HEROES Act introduced by the House provided a Child Tax Credit at $3,600 for children under the age of 6, and $3,000 for children aged 6-17. Columbia University Researchers at the Center on Poverty and Social Policy say this should be the standard rate for CTC, as it will reduce the child poverty rate for African Americans in half, and reduce it by 42 percent for all U.S. children.

Figure 2

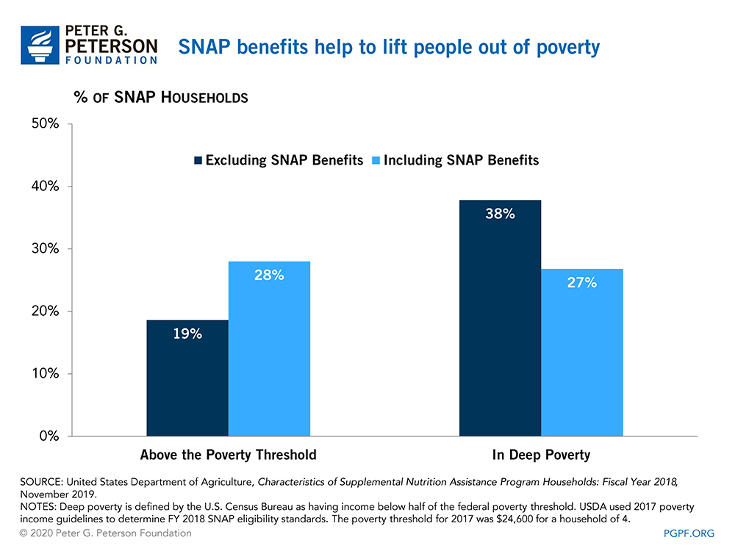

The Impact of the Supplemental Nutrition Assistance Program on Food Insecurity

Food insecurity in children has been linked to poor mental and physical health outcomes, a decline in social capabilities, as well as low academic performance. Research has shown that children receiving the Supplemental Nutrition Assistance Program (SNAP) are more likely to finish high school and less likely experience detrimental health outcomes such as obesity, stunted growth, and heart disease as adults. In 2018, nearly 13 million children, or 1 in 6 children, lived in food insecure households, but the Supplemental Nutrition Assistance Program (SNAP) helped lift 1.4 million children out of poverty — and it is playing a key role in our current crisis. To optimize SNAP’s reach, the Children’s Defense Fund recommends increasing the maximum benefit for all households by 31 percent, based on the U.S. Department of Agriculture’s Low-Cost Food Plan.

While millions of children suffer poverty, hunger, and unstable housing conditions, the wealthiest families and corporations in America receive massive tax cuts. In 2017, Congress passed a tax bill that was projected to give over $84 billion in tax cuts to America’s richest 1 percent in 2019 alone—more than the annual cost of the entire SNAP food program. The top 20 percent of households are expected to receive $225 billion in tax cuts in 2019, three-fifths as much as the federal government invested in all programs that explicitly support low-income children in 2017.

Reordering our nation’s priorities would allow children to live healthy, fulfilling lives, and benefit America as a whole. We must provide support for our nation’s most vulnerable, instead of continually serving our nation’s wealthiest. Congress should commit to reducing and ultimately ending child poverty, and reinvest that money in housing assistance, federal nutrition programs, and tax credits that benefit low-income people.