Keeping Americans Housed During COVID-19

Housing during the coronavirus (COVID-19) pandemic is essential to ensuring the stop of the spread of the disease – and there are obvious challenges for people experiencing homelessness. In addition, disruptions in income due to social distancing protocol has gravely affected low-income renters. Keeping these Americans in their homes during this time is crucial for the health and wellbeing of their families and communities.

Unemployment claims are now up to at least 33.5 million, surpassing all of the job gains since the Great Depression. About 31 percent of Americans, or 1 in 3, do not think they will be able to keep a roof over their head if the U.S. falls into a recession. According to the Urban Institute, half of American households with incomes below the poverty line could not afford a $400 unexpected expense. While over 80 percent of American renter households have paid their rent (either partially or in full) this May and federal unemployment benefits have been extended, other forms of assistance, like payments of up to $1200, were one time benefits, causing worry that renters will have trouble paying upcoming rent payments in June and July.

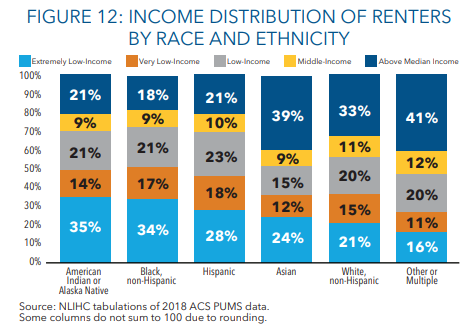

Renters tend to have lower incomes than their homeowner counterparts and cannot tap into the equity in their homes for a credit line in case of an emergency. And a disproportionate number of renters are African American, Hispanic, and other minorities. In an attempt to help low-income renters keep their housing, policymakers across America are implementing a wide variety of supports. These range from placing a moratorium on all evictions, to more limited moratoria for residents who can demonstrate lost wages due to coronavirus – see the EvictionLab tracker for more.

President Trump announced a suspension in foreclosures and evictions for Federal Housing Administration-insured mortgages for single family properties for the next 60 days in addition to the funding provided for housing and homelessness in the CARES Act, passed by Congress in March. Although many homeowners are protected from foreclosure, most low-income renters are not. While $12 billion in additional funding for homelessness and low-income renters is important, it isn’t enough to deal with the immediate needs homeless people are currently facing, or to provide emergency rental assistance to keep millions of low-income renters in their homes.

Congress is already talking of another bill later this spring. The communities already pushed to the margins still face the greatest risks in this pandemic, and our underlying affordable housing crisis means that millions of families struggle to make rent.

As policymakers look at emergency rental assistance, the bipartisan Eviction Crisis Act (S. 3030), introduced by Senator Bennet (D-CO) and Portman (R-OH), is a model – it would establish a federal emergency housing grant program which would provide aid to people experiencing housing insecurity in order to prevent homelessness. A nationwide moratorium on evictions would help renters and homeowners stay housed during the economic crisis — the CARES Act provisions only apply to about 1 in 4 U.S. rental units. In addition, millions of families face weeks or months where they cannot afford rent due to lost wages, and will not be able to come up with past rent due when an eviction moratorium ends. There is a desperate need for emergency rental assistance combined with a nationwide moratorium on evictions. These combined measures would help prevent millions of Americans from losing their homes after the COVID-19 crisis due to an inability to pay back their months of rent that were suspended while ensuring families do not get evicted while they struggle to seek emergency rental assistance.

Background on Federal Housing Programs and Our Underlying Affordable Housing Crisis

The U.S. government has a long history of policies that directly or indirectly blocked or built wealth via housing and beyond. Currently housing assistance is provided for 10 million people in over 5 million households. In 2018, housing assistance alone lifted 3 million people out of poverty.

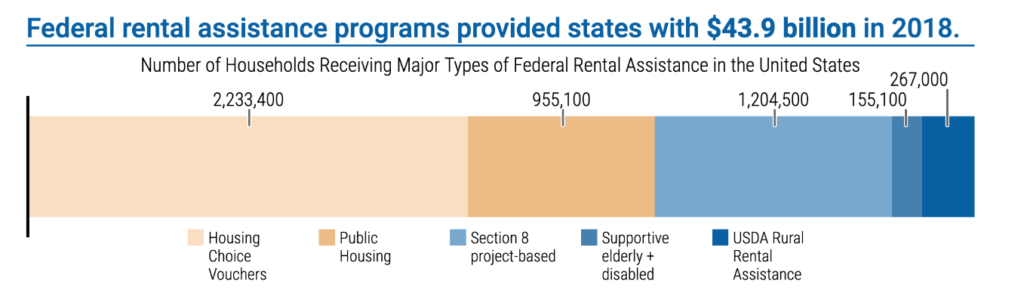

The largest programs that support residents with low-incomes are Section 8 housing choice vouchers, Section 8 project based rental assistance, and public housing (see Figure 2). Funding for these incredibly necessary programs does not keep up with increasing need. As result, 75 percent of eligible households do not receive the housing assistance they need.

Figure 2

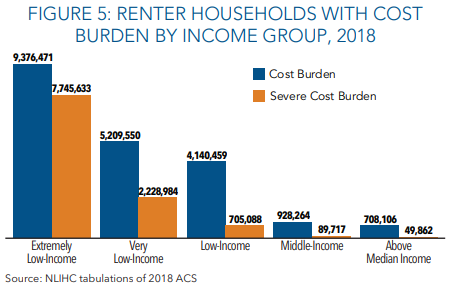

Americans’ income levels have not adjusted with the cost of living. Since 1960, renters’ median earnings have gone up 5 percent while rent payment are up 61 percent. This leaves 18 million lower-income renters paying more than 30 percent of their income on rental cost, qualifying them as housing cost burdened (see Figure 3).

Yet, some households pay half or more of their income on rent — these households qualify as severely housing cost burdened. Severely-cost burdened renters are more likely to have a household income at the poverty line or below 30 percent of the area median income (these households are identified as extremely low-income). Seventy-one percent of extremely low-income households pay more than half their income on rental costs and households of color are more likely to qualify as extremely low-income – see Figure 4 for a further breakdown by race and ethnicity.

Increasing funding for emergency rental assistance end eviction prevention would make a tremendous impact on the lives of low-income renters by allowing them to keep them and their families safe in the homes during this crisis.

Figure 3

Figure 4