EITC Awareness Day

For years, RESULTS volunteers have advocated for expansions of the Earned Income Tax Credit (EITC) because of how successfully the program has supported low- and moderate-income families. This Friday, January 27, 2023 is EITC Awareness Day. This provides an opportunity for us to look closer at why RESULTS has prioritized this policy over the years – I offer some personal reflections on why the EITC is key further below — and how to improve this vital program.

What is the EITC?

The EITC is a refundable tax credit provided to parents with qualifying children or workers without qualifying children (aged 25-64) who have “earned income.” Because the EITC is refundable it can be paid to workers even if they owe little or no federal income tax. Refundability means that if the amount of the credit is larger than a filer’s tax liability, the remainder will be paid as part of their tax return. The lump sum payment allows for larger purchases like a vehicle or vehicle repairs or catch up or pay ahead on their rent to ensure they are stably housed. Transportation and stable housing are needed to maintain employment, pursue educational goals, or even just to go get groceries. This is particularly true in rural areas or areas without reliable public transportation.

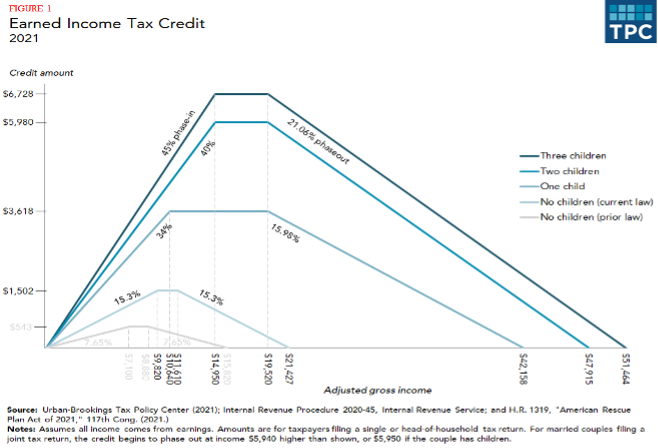

The EITC begins to provide benefits as soon as $1 is earned, increasing as you earn more, and phases out as an individual or family reaches a determined income threshold. It provides a more generous benefit to families with children than those without. For example, in tax year 2022 the maximum EITC amount is $6,935 for a married family with 3 children, compared to a $560 maximum benefit for a single person with no children. This lower amount is often called the “childless EITC”.

| Number of children: | Single workers with income less than: | Married workers with income less than: | EITC up to: |

| 3 or more children | $53,057 | $59,187 | $6,935 |

| 2 children | $49,399 | $55,529 | $6,164 |

| 1 child | $43,492 | $49,622 | $3,733 |

| No children | $16,480 | $22,610 | $560 |

Why advocate for the EITC?

The EITC reduces poverty on a large scale with over 20 million low to moderate-income Americans benefitting from it each year, claiming an average payment of $2,461. Millions of these workers and their children will see their annual incomes rise above the federal poverty line because of the EITC. Because the credit is effectively targeted to low-income families, it is often spent quickly and in the local economy. In fact, every dollar claimed in EITC translates into $1.50 to $2.00 in local economic activity.

The EITC is also one of the few tax credits that helps level the playing field for communities marginalized by systems of power and oppression including Black, Indigenous, Hispanic, and disabled workers. As we know, these systems have forced many members of these communities disproportionately into lower wage jobs and less stable housing situations. A review of tax expenditures completed by the U.S. Treasury found that while Hispanic families are 15 percent of the population, they receive 28 percent of the benefits from the EITC; Black families make up 11 percent of the population yet receive 19 percent of the benefits of the EITC. By comparison, 84 percent of popular credits like the mortgage interest deduction and 92 percent of some capital gains credits are paid to white families who only represent 67 percent of the population.

With a few changes, the EITC could do so much more to support low-income and marginalized communities and families, all while increasing equity in our tax code.

How can the EITC do more to support families who need it?

In 2021, the American Rescue Plan Act (ARPA) expanded the EITC in several important ways. Congress made the EITC available to workers without dependents aged 19-24 and over 64 for the first time in history. This supported many young people who were just starting in the workplace and individuals who had to work long past retirement age. For instance, poverty among workers without dependents between the ages of 18-24 was 7 percent lower than their counterparts who did not claim the EITC.

Note that “current law” refers to the tax law under the ARPA expansion and “prior law” means prior to ARPA expansion, which is also the current value and phase in/out of the EITC.

Additionally, the 2021 EITC expansion almost tripled the amount of the childless EITC from a maximum benefit of $560 to $1560. It also raised the income eligibility cap from $16,000 to $21,000. While this is called the “childless EITC”, many of those who claim it do in fact have children; they just are unable to claim them as dependents for tax purposes (who are called “noncustodial parents”). Thus, the 2021 EITC supported many families and children. However, since the 2021 EITC expansion ended, tax policy is leaving out more than a million non-custodial parents who provide support to their children.

Prior to my work with RESULTS, I served fathers returning from incarceration or who otherwise had a history of engagement in the criminal justice system. Being a parent is hard, even in the best of situations. It is even harder when a parent must overcome massive economic barriers such as employment discrimination, high fees associated with long-term supervision on probation or house arrest, and high child support payments that can garnish as much as 80 percent of their already low paychecks. While some of these dads had custody of their children and could claim the higher EITC benefit for those with dependents, most of them did not.

The 2021 EITC proved that the tax code could provide much needed support to these dads, helping them overcome the many barriers facing them. The increased benefit improved their economic stability, allowing them to provide additional and more consistent financial support to their children. The 2021 expansion was estimated to increase the amount of noncustodial parents who received the EITC from 780,000 to more than 2 million and to increase the average EITC benefit by about $950. Unfortunately, in 2022, Congress allowed this important expansion to expire, taking EITC benefits away from many low-income, non-custodial dads who are trying to financially support their children.

What’s next?

As RESULTS continues to advocate for justice and equity in the tax code, we want it to be clear to Congress that the EITC must be expanded. The 2021 expansion lasted only one year as Congress allowed it to expire, taxing many low-income workers back into poverty. This EITC Awareness Day is an opportunity for us to share about the value of the credit and how it must be expanded. If you want to raise awareness in your circles on EITC Awareness Day, you can use this social media toolkit with sample posts.

If you need help to file your 2022 taxes or claim your EITC, find a VITA site near you for free tax preparation services. These VITA sites can also help you claim your expanded 2021 EITC or CTC.