Cutting child poverty in half

Last weekend, Senator Sherrod Brown of Ohio joined a call with RESULTS volunteers just minutes after the Senate passed the COVID relief bill. After telling RESULTS advocates they “set the standard for citizen activism,” he said that it was “the best day he’s had in the Senate” because of what this bill does against poverty.

Today that bill is headed to the President’s desk, and it includes key changes to the tax code that will be part of cutting child poverty in half in the United States. It also includes further investment in emergency rental assistance and urgent relief against COVID globally.

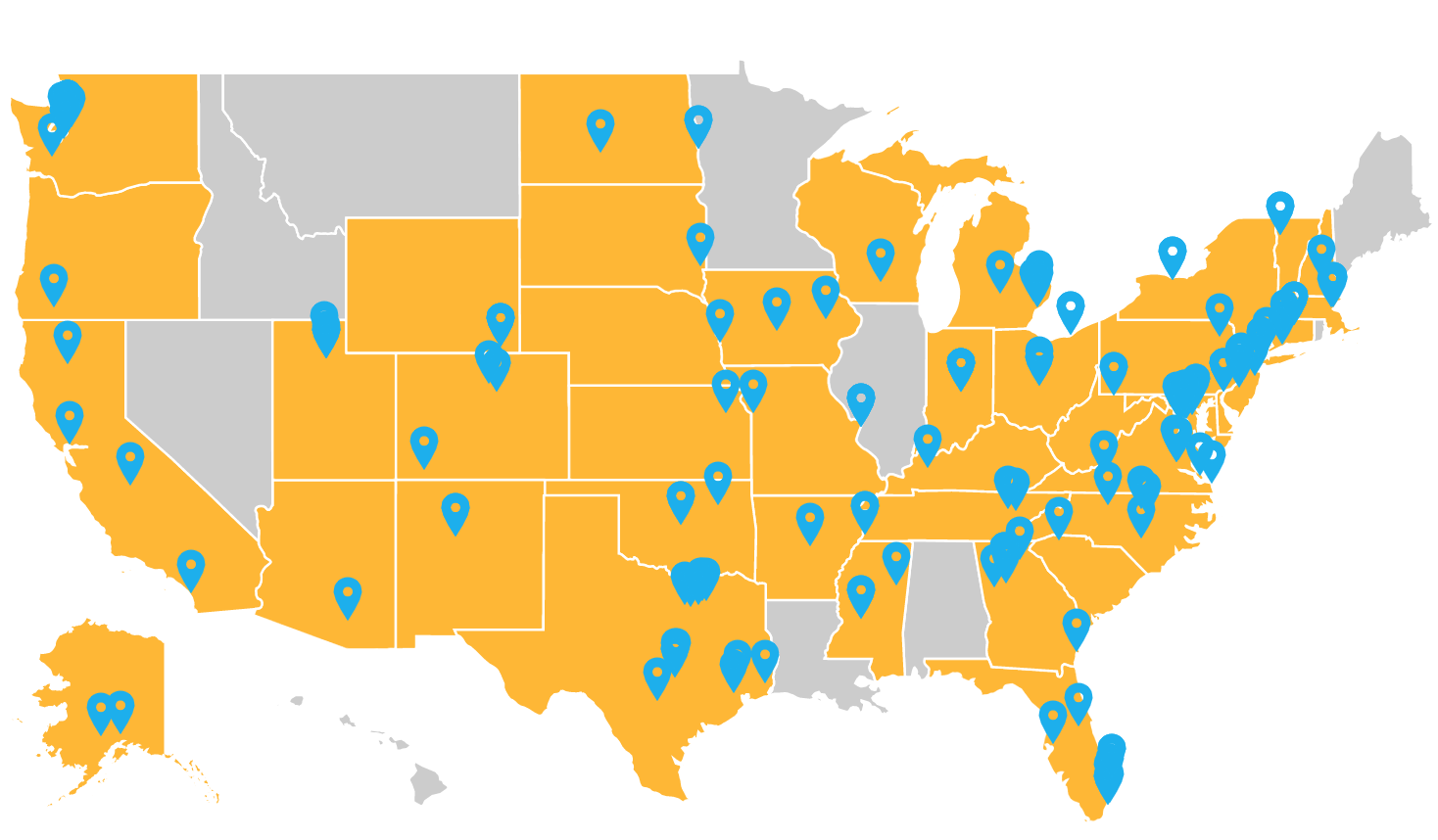

Earlier this year, we kicked off a First 100 Days campaign to help set the agenda against poverty with the new Congress and Administration. Since then, RESULTS advocates have been averaging another congressional meeting every 5 hours, meeting with members of Congress across the political spectrum. And the bill passed today includes all the emergency actions that have been our focus.

Here at home, the bill expands the Child Tax Credit and Earned Income Tax Credit, which were already some of the country’s most powerful tools against poverty. For years, RESULTS volunteers have helped build strong congressional support for both tax credits. These new expansions will help cut the U.S. child poverty rate in half and support 17 million low-wage workers. New emergency rental assistance will also help millions of Americans at risk of eviction.

The bill also provides $11 billion for a global response to the pandemic, including $3.5 billion for the Global Fund to Fight AIDS, Tuberculosis, and Malaria. That $3.5 billion is desperately needed in this emergency, and it’s the biggest ever U.S. commitment to the Global Fund, building on nearly 2 decades of bipartisan advocacy from RESULTS advocates.

Getting these key provisions signed into law is massive progress, but we are absolutely not stopping here. For starters, this is just an emergency package. Even the transformational changes to the tax code are temporary. Without more action from Congress to make the tax credit expansions permanent, child poverty will go back up when the provisions expire next year. Meanwhile, the global response to the pandemic is still vastly underfunded, with dire consequences for millions of people.

We will keep making sure policymakers understand that poverty was a crisis long before the pandemic. As Congress turns to what’s ahead, we’ll be pushing for policies that actively undo the forces of racism, colonialism, and oppression that drive poverty and injustice. We will show them the need and demand not just for modest progress, but for lasting change.